Handling a guest’s injury isn’t about being nice; it’s about executing a precise legal strategy from the very first minute to protect your life’s savings.

- Your immediate actions and words can either build your defense or hand a plaintiff’s attorney a winning case.

- Standard homeowner’s insurance is often dangerously insufficient, and how your policy covers defense costs can be the difference between solvency and bankruptcy.

Recommendation: Shift your mindset from reactive panic to proactive defense by documenting everything, understanding your policy’s fine print, and structuring your assets to be resilient long before an incident ever occurs.

As a homeowner, hosting friends and family is a source of joy. But in the blink of an eye, a slip on a wet floor or a fall from a step can turn a social gathering into a financial nightmare. Suddenly, you’re facing the daunting prospect of a personal injury claim. Many people believe that having homeowner’s insurance is enough, or that a simple “I’m sorry” will smooth things over. This is a critical misunderstanding of premises liability law.

The reality is that how you respond in the first hour, the specific words you use, and the adequacy of your insurance coverage are far more important than you can imagine. Most online advice offers a generic checklist: get medical help, call your insurer, don’t admit fault. While correct, this advice barely scratches the surface. It fails to explain the strategic legal implications behind each action. It doesn’t tell you *why* a seemingly harmless apology can void your coverage or how the structure of your policy could force you into bankruptcy even if you win the case.

This guide moves beyond the platitudes. As a defense attorney specializing in civil liability, my goal is to give you the strategic playbook that plaintiff’s attorneys hope you don’t have. We will not just cover what to do; we will dissect the legal and financial mechanics at play. The difference between a minor insurance claim and a life-altering lawsuit often comes down to knowledge. This article is your first line of defense, designed to help you contain liability and build an asset fortress that can withstand a legal challenge.

This article will provide a clear roadmap, from the immediate aftermath of an incident to the long-term strategies for financial protection. We will break down the crucial steps and strategic considerations you need to understand to navigate this complex situation with confidence.

Summary: A Strategic Guide to Handling Guest Injury Claims

- Why a Slippery Sidewalk Can Cost You More Than a Kitchen Renovation?

- What to Do in the First Hour After a Guest Gets Injured?

- Reviewing Liability Limits: Is $1 Million Enough for a Family with Teenagers?

- The Apology That Could Void Your Liability Coverage Instantly

- How to Liability-Proof Your Pool Area Before Summer Starts?

- Why Your Friendly Dog Could Increase Your Civil Liability Risk?

- Defense Costs Inside or Outside Limits: Which Prevents Bankruptcy?

- How to Protect Your Assets from Civil Liability Lawsuits?

Why a Slippery Sidewalk Can Cost You More Than a Kitchen Renovation?

Homeowners often think of their property in terms of its market value or renovation costs. A new kitchen or bathroom is a tangible, significant expense. Yet, a single moment of negligence can lead to a liability claim that dwarfs those costs. The concept of premises liability holds you, the property owner, responsible for ensuring a reasonably safe environment for visitors. A failure to do so, whether it’s an icy walkway, a loose handrail, or poor lighting, can be legally defined as negligence.

The financial consequences are not abstract. A seemingly minor incident can quickly escalate into a major financial event involving medical bills, lost wages, and pain and suffering. According to an analysis of homeowners insurance data, the average liability claim was $22,363 in 2019, a figure that has likely increased. More severe injuries involving surgery or long-term disability can easily result in claims reaching six or even seven figures, far exceeding the cost of any home improvement project.

Understanding this risk is the first step in protecting yourself. It’s not about being paranoid; it’s about being prepared. The law doesn’t care if the injured person is a stranger or your best friend. If negligence is established, your personal assets are potentially on the line. This is why viewing your home not just as a place to live, but as a potential source of significant financial risk, is a critical mindset shift for every property owner.

What to Do in the First Hour After a Guest Gets Injured?

The 60 minutes following an injury on your property are the most critical period for liability containment. Your actions during this time can significantly influence the outcome of any potential legal claim. The primary goals are to ensure the injured person receives care, prevent further harm, and begin the process of strategic documentation. This is not the time for guesswork; it is the time for a calm, methodical response.

First and foremost, seek immediate medical attention for the guest. This is both a moral imperative and a legally prudent step. Document the time you called for assistance. While help is on the way, you must begin to preserve the scene. This means taking comprehensive photographs and videos from multiple angles before anything is moved or altered. Capture the overall area, the specific hazard (e.g., the wet spot, the broken step), lighting conditions, and any other contributing factors. This objective evidence is invaluable.

If there are witnesses, get their names and contact information. It’s wise to get a brief, individual account from each person before they have a chance to confer and align their stories. Throughout this process, express concern for the injured person’s well-being, but do not admit fault or speculate on the cause. The difference between “I’m so sorry you’re hurt” and “I’m so sorry my old stairs gave out” is legally massive. Finally, contact your insurance agent to report the incident as soon as the immediate crisis is managed. This early reporting is often a requirement of your policy.

The image above illustrates a crucial action: creating a clear, objective record. This strategic documentation is not an admission of guilt; it is the foundation of your defense. A detailed, time-stamped visual record can protect you from exaggerated or false claims down the line. It provides your insurer and legal counsel with the facts needed to properly assess the situation.

Action Plan: Your First-Hour Evidence Protocol

- Call for medical assistance immediately and document the exact time of the call.

- Take comprehensive photos and videos of the accident scene from multiple angles before anything is moved.

- Collect contact information and brief statements from any witnesses separately, before they can confer.

- Document environmental factors like weather conditions, lighting levels, and any other contributing elements objectively.

- Express concern for the injured person’s well-being (e.g., “I’m sorry you’re hurt”) without admitting fault (e.g., “I’m sorry my step broke”).

- Contact your insurance company within the first hour to make an initial report of the incident.

- Create a private, written timeline of the events as you remember them while the details are still fresh in your mind.

Reviewing Liability Limits: Is $1 Million Enough for a Family with Teenagers?

Many homeowners assume their insurance policy is a catch-all safety net. The sobering reality is that the default liability coverage is often dangerously inadequate. According to premises liability legal experts, most policies provide a minimum of $100,000 in liability protection. In today’s world, where a single serious injury can lead to hundreds of thousands in medical bills and legal judgments, this amount is little more than a down payment on a major claim.

Reviewing your liability limits isn’t a task to put off; it’s a fundamental part of your financial defense. The right amount of coverage depends on your personal risk profile. Do you have a pool, a trampoline, or a large dog? Do you have teenage drivers? Do you frequently host large parties? These factors, known as “risk elevators,” significantly increase your exposure. A family with young children and a dog has a different risk profile than a retired couple in a condo. Your coverage should reflect your life, not a generic standard.

A good rule of thumb is to have enough liability coverage to protect your total net worth. For many, this means increasing standard homeowner’s liability from $100,000 to $300,000 or $500,000. For those with significant assets or higher risk profiles, an umbrella policy is essential. An umbrella policy provides an additional layer of liability protection—typically starting at $1 million—that kicks in after your primary homeowner’s or auto insurance limits are exhausted. The cost is surprisingly affordable for the peace of mind it provides.

This table offers a clear comparison of different coverage levels and their suitability for various risk scenarios. Use it as a starting point to assess whether your current protection aligns with your potential exposure.

| Coverage Level | Annual Cost | Protection Scenario | Risk Assessment |

|---|---|---|---|

| $100,000 | $100-150 | Minor injuries, basic medical | Insufficient for serious claims |

| $300,000 | $200-300 | Moderate injuries, lost wages | Adequate for typical incidents |

| $500,000 | $300-450 | Serious injuries, legal fees | Good for families with assets |

| $1 Million+ | $450-600 | Catastrophic injuries, multiple claims | Essential for high net worth |

The Apology That Could Void Your Liability Coverage Instantly

In the aftermath of an injury, human instinct is to comfort and apologize. However, in the world of civil liability, your words are evidence. A simple, well-intentioned apology like, “I’m so sorry, I should have fixed that step,” can be legally interpreted as an admission of liability. This can be devastating to your defense and may even give your insurance company grounds to deny your claim.

Every insurance policy contains a “cooperation clause.” This clause requires you to cooperate with the insurer in their investigation and defense of a claim. It also explicitly prohibits you from voluntarily assuming any obligation or making any payment. Admitting fault can be seen as a violation of this clause, as you have undermined the insurer’s ability to defend the case. You have effectively given the opposing side their most powerful piece of evidence.

This does not mean you should be cold or unfeeling. There is a crucial difference between expressing empathy and admitting fault. Learning to navigate this distinction is a key defense skill. The following script outlines safe and dangerous ways to communicate after an incident.

Safe vs. Dangerous Statements After an Injury

- SAFE: “I’m so sorry you’re going through this.” (Expresses empathy without fault)

- DANGEROUS: “It was my fault, I should have fixed that.” (Direct admission of liability)

- SAFE: “Let me help you get medical attention.” (Offers assistance without admission)

- DANGEROUS: “I knew that step was broken.” (Admits prior knowledge of a hazard)

- SAFE: “Are you okay? What do you need?” (Shows concern without assuming liability)

- DANGEROUS: “Don’t worry, my insurance will cover everything.” (May violate the cooperation clause by promising payment)

It is important to remember that showing basic human decency is not an admission of guilt. As legal analysts from the San Francisco Trial Lawyers clarify, your actions and words should be carefully considered. They offer this important perspective:

Assisting an injured party does not necessarily constitute an admission of guilt or legal liability. Offering basic support, such as calling for medical attention, does not automatically mean you are at fault for the accident.

– San Francisco Trial Lawyers, Premises Liability Legal Analysis

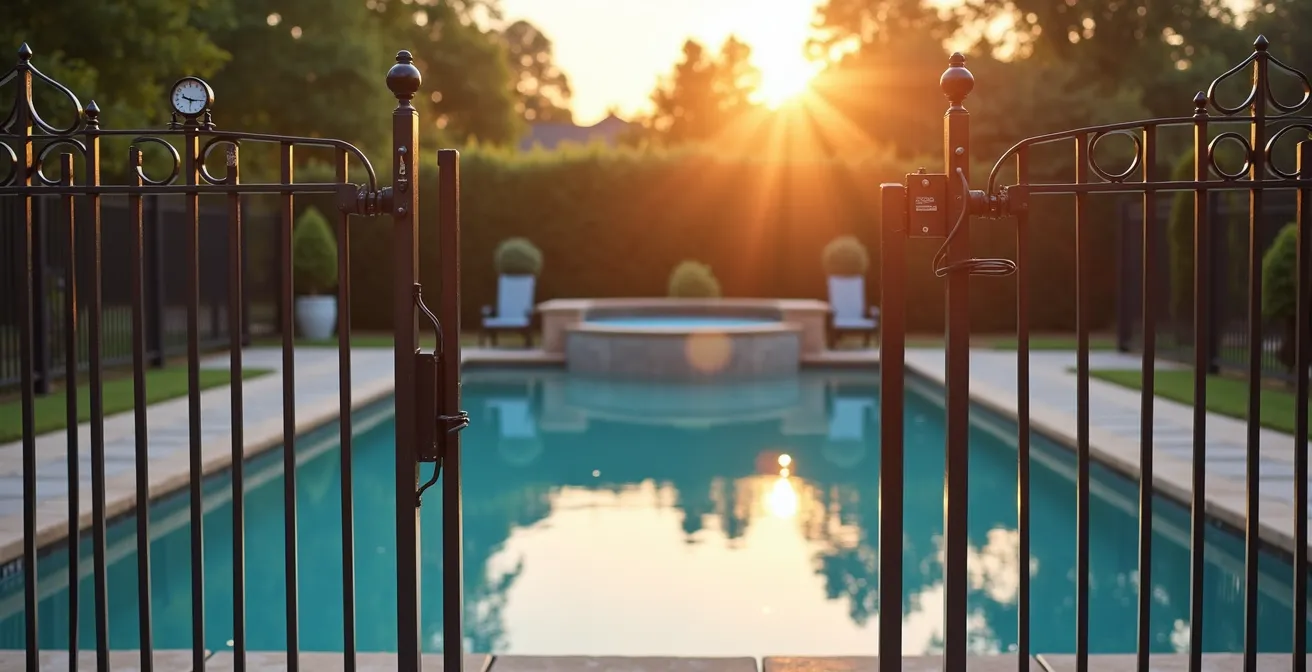

How to Liability-Proof Your Pool Area Before Summer Starts?

Certain features on your property act as magnets for both guests and liability. Swimming pools, trampolines, and playsets fall under a legal concept known as the “attractive nuisance” doctrine. This doctrine holds property owners to a higher standard of care when they have a feature that might attract children who are unable to appreciate the risks involved. A homeowner’s duty to protect trespassers is normally low, but it increases dramatically when an attractive nuisance is present, especially concerning children.

Failing to secure these areas properly is a significant legal risk. Proactively “liability-proofing” them before the high-risk summer season is not just good sense; it’s a critical defensive measure. For a pool area, this means implementing multiple layers of safety. This includes a four-sided fence at least four feet high with a self-closing, self-latching gate. Pool alarms, safety covers, and readily accessible rescue equipment like life rings and shepherd’s hooks are also essential components.

The consequences of failing to take these precautions can be severe, as illustrated by a common type of premises liability case.

Case Study: The Unsecured Trampoline

A homeowner had a trampoline in their unfenced backyard but had not installed a safety net around it. A neighbor’s child wandered into the yard, used the trampoline, fell, and sustained a broken leg. The court found the homeowner negligent. The trampoline was deemed an attractive nuisance, and the owner had failed to take reasonable steps to prevent foreseeable harm to a child. Insurers often react to these risks by increasing premiums, adding exclusions, or even refusing to cover properties with pools and trampolines that lack adequate safety measures.

Think of these safety features not as expenses, but as investments in liability protection. A secure fence and a pool alarm are far cheaper than a lawsuit. Regularly inspecting these features to ensure they are in working order and documenting your maintenance efforts can provide powerful evidence that you have met your duty of care.

Why Your Friendly Dog Could Increase Your Civil Liability Risk?

For most owners, a dog is a beloved member of the family. From a legal standpoint, however, a dog is a potential source of significant liability. Dog-related incidents are one of the most common and costly types of homeowner’s insurance claims. According to Insurance Information Institute data, the average payout for a dog bite claim was $50,425 in 2020, and this figure continues to rise.

Liability laws for dog bites vary by state. Some states follow a “one-bite rule,” where an owner may not be liable for the first time a dog bites someone if they had no reason to believe the dog was dangerous. However, many other states have adopted strict liability statutes. Under strict liability, the owner is legally responsible for any injury caused by their dog, regardless of whether the dog had ever shown aggression before. Your dog’s friendly nature is not a legal defense in these states.

Given this risk, it is strategically wise to build a “Good Dog Defense Portfolio” before an incident ever occurs. This involves proactively gathering documentation that demonstrates you are a responsible pet owner. This portfolio can be invaluable to your insurance company’s defense team in the event of a claim, potentially helping to mitigate damages or negotiate a more favorable settlement. It shows a pattern of care and responsibility that can counter an argument of negligence.

Your “Good Dog” Defense Portfolio Checklist

- Obtain a Canine Good Citizen (CGC) certification from the American Kennel Club or a similar organization.

- Maintain detailed veterinary records that show regular check-ups, vaccinations, and any notes on temperament.

- Document all professional obedience training with certificates and statements from the trainer.

- Keep photographic evidence of your property’s containment systems, such as secure fences, gates, and leashes.

- Review your homeowner’s policy for any breed-specific exclusions or lower coverage sub-limits for dog bites.

- Consider adding or increasing your umbrella policy if you own a breed that is often on insurers’ “restricted” lists.

Defense Costs Inside or Outside Limits: Which Prevents Bankruptcy?

When you are sued, two major costs emerge: the potential settlement or judgment paid to the injured party, and the legal fees required to defend you. A detail buried in your insurance policy—whether defense costs are inside or outside the limits of your liability coverage—can be the difference between financial security and ruin, even if you are ultimately found not at fault.

If defense costs are “inside the limits,” the money spent on legal fees is subtracted from your total liability coverage. For example, if you have a $500,000 limit and your legal defense costs $150,000, you only have $350,000 left to pay any potential judgment. If the judgment is for $500,000, you are personally responsible for the $150,000 shortfall.

Conversely, if defense costs are “outside the limits,” the insurer pays for your legal defense without depleting your liability coverage. In the same scenario, the insurer would cover the $150,000 in legal fees, and your full $500,000 liability limit would remain available to pay the judgment. This is a vastly superior form of coverage. Most standard homeowner’s policies and umbrella policies offer defense costs outside the limits, but you must verify this in your own policy documents.

The following table starkly illustrates the impact of this single policy provision in a major claim scenario, showing how quickly your personal assets can become exposed when defense costs are inside the limits.

| Coverage Type | $500K Claim Scenario | Legal Defense Cost | Available for Settlement | Homeowner Out-of-Pocket |

|---|---|---|---|---|

| Defense Inside Limits | $500K policy limit | -$150K legal fees | $350K remaining | $150K personal liability |

| Defense Outside Limits | $500K policy limit | Separate coverage | Full $500K available | $0 if within limits |

The reassuring news is that you typically do not have to find or pay for a lawyer yourself. As legal experts at AllLaw note, this is a key benefit of your coverage.

The insurance company will typically appoint—and pay for—an attorney to deal with any lawsuit that stems from the underlying incident. You probably won’t need to hire your own lawyer, which is good news for your wallet.

– Legal Expert Analysis, AllLaw Personal Injury Claims Guide

Key Takeaways

- Your response in the first hour after an injury is critical for liability containment and strategic documentation.

- Standard homeowner’s liability limits are often dangerously low; assess your net worth and risk factors to determine if you need an umbrella policy.

- Expressing empathy is safe, but admitting fault can void your insurance coverage by violating the policy’s cooperation clause.

How to Protect Your Assets from Civil Liability Lawsuits?

Your homeowner’s insurance is your first line of defense, but it shouldn’t be your only one. In the event of a catastrophic claim that exceeds your policy limits, a plaintiff’s attorney will look to your personal assets to satisfy the judgment. Building an “Asset Fortress” is the final, crucial layer of protection. This involves legally structuring your finances to make them more resilient to lawsuits, a process best done long before any incident occurs. According to National Safety Council statistics, 52% of personal injury cases arise from incidents on another person’s property, highlighting the pervasive nature of this risk.

The vulnerability of your assets varies. Cash in checking and savings accounts is the most exposed and easily seized. Brokerage accounts and non-homestead real estate are also prime targets. Conversely, certain assets receive special legal protection. Retirement accounts like 401(k)s and IRAs are generally shielded from creditors under federal law. Your primary residence (homestead) also receives significant protection, though the amount varies widely by state.

The goal of asset protection is to move wealth from more vulnerable categories to less vulnerable ones where legally permissible. This might involve maximizing contributions to retirement accounts or understanding the full extent of your state’s homestead exemption. For more complex situations, especially for those who own rental properties, establishing legal structures like Limited Liability Companies (LLCs) can create a firewall, separating business liability from your personal assets. These strategies require careful planning with legal and financial professionals but are an essential part of a comprehensive defense strategy.

Pre-Incident Asset Protection Strategies for Homeowners

- Review and understand the homestead exemption laws in your state to know how much of your home’s equity is protected.

- For married couples, explore holding property as “tenancy by the entirety” in states where this is available, as it can protect property from the individual debts of one spouse.

- Establish separate LLCs for any rental properties to isolate their liability from your personal assets.

- Ensure your liability and umbrella coverage limits are high enough to at least match your total net worth.

- Maintain meticulous records of all property maintenance and safety measures taken, creating a paper trail of your diligence.

Your next step is to conduct a thorough review of your current homeowners and umbrella policies. Use this guide as a framework to identify potential gaps in your coverage and to begin a conversation with your insurance agent or a financial advisor about strengthening your financial defenses before an incident ever occurs.