Standard homeowner’s insurance is dangerously inadequate for high-value detached structures, as coverage is determined by functional use and technical definitions, not architectural appearance.

- An insurer’s classification of “detached” can override obvious physical connections, immediately limiting your coverage.

- Any business or rental activity, even incidental, can create critical liability and property damage gaps that void a standard policy.

Recommendation: Adopt an underwriter’s mindset to deconstruct your property’s risk profile and work with an independent broker to build a layered, tailored insurance portfolio.

As a property owner, you’ve invested significantly in creating a high-value detached structure—a sophisticated garden office, a comfortable granny flat, or a custom-built studio. You assume your homeowner’s insurance has it covered. This assumption is where significant financial risk begins. The standard advice to simply “check your policy” or “add an endorsement” is superficial and fails to address the complex underwriting realities that govern these unique assets. Insurers operate on a strict set of definitions that often defy a homeowner’s logic.

The problem isn’t just about the structure’s value exceeding the typical 10% limit for “Other Structures.” It’s about its functional identity. Is it a place of business? A source of rental income? Is it technically “attached” or “detached” according to a specific carrier’s rules? Each of these questions can fundamentally alter your coverage, and a misstep can lead to a claim being denied entirely. The disconnect between what you see as a connected part of your home and what an underwriter classifies as a separate risk is a chasm where policies are voided.

This guide moves beyond generic advice. We will adopt an underwriter’s lens to dissect the specific loopholes and exclusions that leave owners of high-value detached structures exposed. Instead of simply listing policy types, we will explore the critical classification tests, the business activity triggers that nullify coverage, and the appraisal requirements for custom builds. You will learn not just what to do, but why, enabling you to build a truly resilient insurance portfolio that protects your investment as meticulously as you built it.

This article provides a detailed breakdown of the critical insurance considerations for your detached structures. The following summary outlines the key areas we will explore to ensure your assets are properly protected.

Summary: Navigating Insurance for Detached Structures

- Why Your “Attached” Garage Might Be Considered Detached by Insurers?

- How to Cover a Home Office in a Shed Without Voiding Your Policy?

- 10% Limit vs Specific Rider: Which Is Best for a Luxury Pool House?

- The Rental Mistake That Leaves Your Granny Flat Uninsured

- When to Get a Separate Appraisal for Custom Garden Structures?

- The Unpermitted Addition That Could Void Your Dwelling Coverage

- The “Business Activity” Exclusion That Voids Your Policy During a Rental

- How to Build a Tailored Insurance Portfolio for an Eccentric Lifestyle?

Why Your “Attached” Garage Might Be Considered Detached by Insurers?

The distinction between an “attached” and “detached” structure seems straightforward, but in underwriting, it is a technical classification with significant financial consequences. A structure you consider attached because of a physical link, like a garage connected by a breezeway, may be classified as detached by your insurer. This instantly subjects it to the much lower coverage limits of “Other Structures” (Coverage B), leaving a high-value asset underinsured.

Insurers often apply a strict test known as the “continuous heated living envelope.” This principle dictates that for a structure to be considered attached, it must be connected to the main dwelling by a space with finished walls, flooring, and, most importantly, a shared heating and cooling system. An open-air breezeway or a simple roof extension without a shared foundation or integrated HVAC system fails this test. For example, a homeowner’s garage connected by a breezeway was deemed detached because the connection lacked a conditioned envelope, despite the physical linkage.

This classification is not arbitrary; it’s based on risk. A separate, unheated structure presents a different risk profile for perils like fire, freezing pipes, or pest infestation. Understanding your insurer’s specific definition is the first step in assessing your true coverage. You must look past the visual connection and analyze the structural and functional integration from an underwriter’s perspective.

Your Action Plan: Foundation and Roofline Assessment

- Verify foundation continuity: Check if the structure shares an uninterrupted foundation with the main house.

- Examine roofline integration: Determine if the structures share a single, cohesive roofline without a clear break or separation.

- Test the “clear space” rule: Confirm if the structure is physically separate from your home, as even a small gap can trigger a “detached” classification.

- Document heating/cooling connections: Note if HVAC systems are shared between the main house and the structure or are entirely separate.

- Review policy language: Scrutinize your policy for the specific definition of “other structures” used by your carrier, as this is the ultimate authority.

How to Cover a Home Office in a Shed Without Voiding Your Policy?

The rise of remote work has transformed sheds and outbuildings into valuable home offices. However, this shift in functional use is a major red flag for insurers. A standard homeowner’s policy is designed for personal, not business, activities. Conducting business from a detached structure without the proper coverage can void your policy precisely when you need it most, leaving both your business assets and the structure itself unprotected from liability or damage.

The key is the distinction between “incidental use” and “business use.” If your work is limited to a computer and phone with no client visits or inventory storage, it may fall under incidental use, which some policies tolerate. However, the moment you host a client, store products, or use specialized equipment, you cross into business territory. Standard policies explicitly exclude liability and property damage related to business operations. This means if a client slips and falls, or a fire is caused by business equipment, your claim will likely be denied.

Standard coverage for “other structures” is already limited; a typical policy often caps this at a percentage of your main dwelling’s value. For instance, coverage for other structures is usually limited to 10% of your dwelling coverage. For a $500,000 home, that’s just $50,000—often insufficient for a well-appointed office, let alone the business assets inside. To properly protect yourself, you must declare the business use to your insurer and secure either a business property endorsement or a separate, dedicated business insurance policy.

The level of business activity directly determines the type of coverage you need, as a standard policy is not designed to cover commercial risks. This table illustrates how insurers classify different activities.

| Business Activity Level | Insurance Classification | Coverage Impact |

|---|---|---|

| Computer work, no clients | Incidental Use | May be covered under standard homeowners |

| Client meetings on-site | Business Use | Standard homeowners insurance won’t cover business-related liabilities or property damage. You must get a separate business insurance policy |

| Inventory storage | Commercial Activity | Requires business property endorsement |

| Specialized equipment use | Professional Use | Needs dedicated business coverage |

10% Limit vs Specific Rider: Which Is Best for a Luxury Pool House?

For owners of high-value detached structures like a luxury pool house, a guesthouse, or a custom workshop, the standard 10% “Other Structures” coverage is fundamentally inadequate. This default limit is a common source of underinsurance, as the replacement cost of a premium structure with high-end finishes, custom appliances, and complex systems can easily dwarf this amount. Relying on it is a significant financial gamble.

This is where you must make a strategic choice between accepting the default limit and proactively securing adequate protection. The solution is typically a scheduled personal property endorsement, also known as a rider. This addition to your homeowner’s policy allows you to list a specific structure and insure it for its full appraised value, overriding the 10% cap. While this increases your premium, it ensures you can fully rebuild without absorbing a massive out-of-pocket expense.

The decision process should be driven by a clear-eyed valuation. First, create a detailed inventory of the structure and its contents, including custom features like outdoor kitchens, A/V systems, or saunas. Next, obtain a professional appraisal to establish a formal replacement cost. If this value significantly exceeds your 10% limit, a rider is not just an option—it’s a necessity. Furthermore, ensure the policy is for “Replacement Cost Value” (RCV), not “Actual Cash Value” (ACV), which would deduct depreciation and leave you short. You may also need to add an endorsement to increase your policy limit for these custom features.

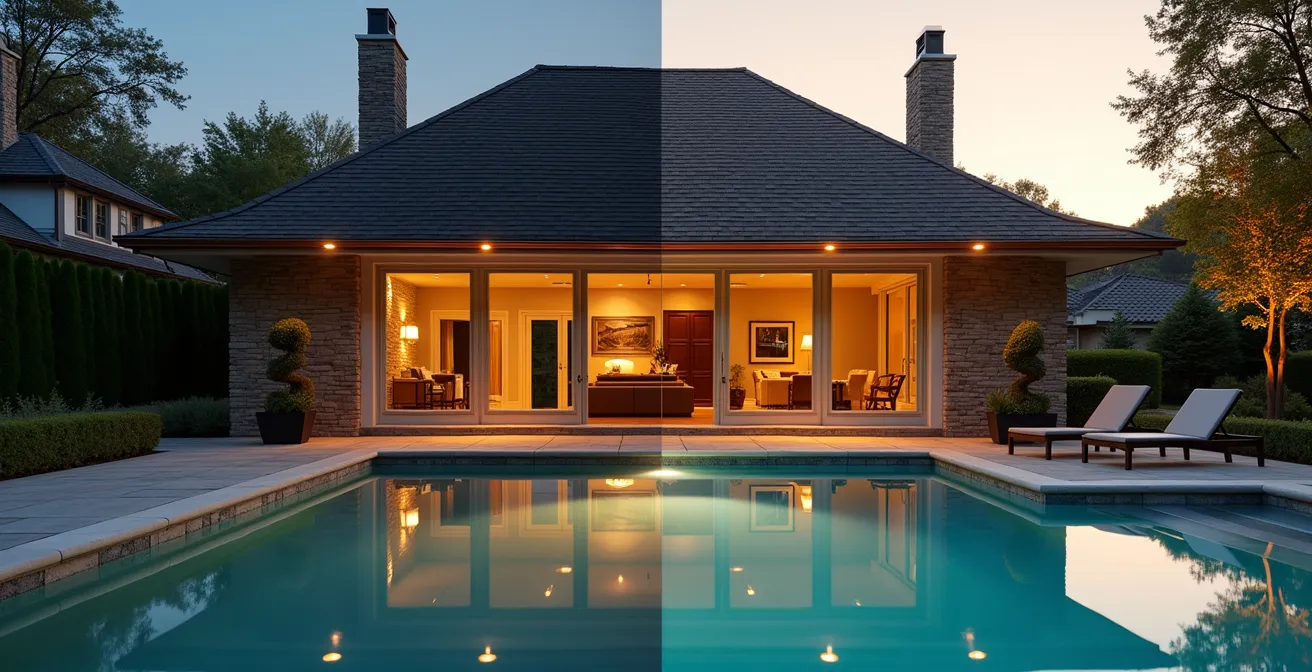

The difference in protection between standard coverage and a specific rider is stark. The illustration below visualizes how a scheduled endorsement fully illuminates and protects your high-value asset, while standard coverage leaves it in the shadows of risk.

As the visual metaphor suggests, a specific rider provides comprehensive protection, ensuring every detail of your luxury structure is covered for its true worth. Without it, you are only partially insured against loss.

The Rental Mistake That Leaves Your Granny Flat Uninsured

Renting out an ADU or granny flat is an excellent way to generate income, but it fundamentally changes the risk profile of your property. The most common and costly mistake is assuming your standard homeowner’s policy will cover a rental unit. It will not. Once a tenant occupies the space, your property shifts from a personal residence to a commercial enterprise in the eyes of an insurer, and a standard policy’s liability and property protections are effectively voided for that structure.

To be properly covered, you must secure a landlord insurance policy (often called a DP-3 policy). This is specifically designed for rental properties and covers property damage to the structure, liability for tenant injuries, and even loss of rental income if the unit becomes uninhabitable due to a covered peril. Expect this coverage to be more expensive; rental property policies tend to be 15% to 25% more expensive than standard homeowners insurance due to the increased liability risks associated with tenants.

Case Study: Short-Term vs. Long-Term Rental Coverage

The distinction between long-term and short-term rentals (e.g., via Airbnb) is critical. A standard landlord policy (DP-3) is designed for long-term leases and may be voided by the high turnover and commercial nature of short-term rentals. For properties listed on platforms like Airbnb, insurers may require a specific home-sharing endorsement or even a full commercial business policy. Failing to secure the correct type of policy for your rental activity creates a massive coverage gap, as a claim arising from a short-term guest would not be covered under a traditional landlord policy.

Ignoring this distinction is not a risk worth taking. A fire caused by a tenant or a liability lawsuit from a guest’s injury could be financially catastrophic without the right policy in place. The premium increase for proper landlord or commercial coverage is a small price to pay for true peace of mind and financial security.

When to Get a Separate Appraisal for Custom Garden Structures?

While a standard shed or gazebo might be adequately covered by your policy’s default 10% limit, custom-built or architecturally unique structures demand a more sophisticated approach to valuation. If your garden features a Japanese tea house with authentic materials, a studio with specialized acoustic treatments, or an observatory with a retractable roof, an insurer’s standard valuation methods will inevitably fall short, leaving you severely underinsured. An appraisal is no longer optional; it becomes an essential step in securing proper coverage.

An insurer typically calculates replacement cost using standardized, per-square-foot data. This method fails to account for unique materials, specialized labor, and artisanal craftsmanship. Imported woods, custom millwork, intricate joinery, or non-standard construction methods are not captured in their algorithms. For example, someone with a basic shed may be protected with standard 10% coverage. However, someone with a pool, guest house, and gazebo could need notably more coverage to adequately protect their structures.

A separate appraisal by a certified professional familiar with luxury or custom amenities is the only way to formally document the true replacement cost. To prepare for this, you must compile a comprehensive dossier for the appraiser, including the builder’s original contracts, invoices for specialty materials, photographs of unique architectural features, and documentation of any artisan certifications. This evidence-based approach provides the underwriter with the justification needed to issue a scheduled endorsement for the structure’s full, documented value.

For structures defined by their craftsmanship, like an authentic Japanese tea house, a detailed appraisal is the only way to capture their true value. The focus shifts from square footage to the intricate details of their construction.

As this image suggests, the value is in the details that standard insurance metrics miss. An appraisal translates that unique craftsmanship into a defensible number for your policy.

The Unpermitted Addition That Could Void Your Dwelling Coverage

The existence of unpermitted work on your property is one of the most severe risks you can face as a homeowner. It is not just a building code violation; it is a ticking time bomb for your insurance coverage. If a detached structure or an addition was built without the required permits and inspections, an insurer could use this fact to deny a claim or even rescind your entire policy, leaving you with zero coverage for any damage, even to the legally permitted main house.

The legal principle at play is “material misrepresentation.” When you purchase a policy, you are warranting that the property meets all legal and safety standards. An unpermitted structure is a breach of this warranty. Insurers view it as an unknown and unquantifiable risk. If a fire starts due to faulty, uninspected wiring in an illegal garage conversion, the insurer may not only deny the claim for the garage but also argue that your failure to disclose the unpermitted work voided the entire contract. This is a surprisingly common issue, as some experts estimate that up to 50% of homes in the US have some form of unpermitted work.

Case Study: Policy Rescission After Unpermitted Work

In a documented case, a homeowner failed to disclose an unpermitted garage conversion to their insurer. When faulty wiring within that illegal construction caused a fire that spread to the main house, the insurance company investigated. Upon discovering the lack of permits, they rescinded the policy retroactively due to material misrepresentation. The homeowner was left responsible for the full cost of repairs to both the garage and the main dwelling, a financially devastating outcome.

If you discover or suspect unpermitted work on your property, you cannot afford to ignore it. The only safe path forward is to legitimize the structure. This involves contacting your local building department to apply for a retroactive permit, hiring licensed professionals to create “as-built” drawings, making any necessary upgrades to meet current code, and passing a final inspection. Only after receiving a Certificate of Occupancy can you present the documentation to your insurer to have the structure formally and legally added to your policy.

The “Business Activity” Exclusion That Voids Your Policy During a Rental

Even if you have the correct landlord insurance for your rental ADU, a dangerous loophole can still exist: the business activities of your tenant. Your landlord policy is designed to cover residential use by the tenant. If your tenant begins operating a business out of the unit—especially one that involves clients visiting the property or storing inventory—it can trigger a “business activity” exclusion in your policy, potentially voiding your coverage in the event of a claim related to that business.

From an underwriting perspective, the risk has changed. A home daycare, an auto repair business, or even a small-scale e-commerce operation with significant inventory introduces liabilities your policy was not priced to cover. If a client of your tenant’s business is injured on the property, your landlord liability coverage may not respond. This is because personal insurance, including standard landlord policies, does not cover commercial activity. The responsibility falls on you, the property owner, to control the use of your property.

The most effective tool for managing this risk is a meticulously drafted lease agreement. Your lease should explicitly prohibit or strictly limit business activities. For low-risk activities (e.g., remote computer work), it may be acceptable, but it should still be documented. For higher-risk operations, the lease should either forbid them entirely or require the tenant to carry their own commercial liability and property insurance, naming you as an “additional insured.”

If your base landlord policy has a business activity exclusion, the umbrella provides $0 of additional coverage for a business-related liability claim. It’s not a catch-all solution.

– Independent Insurance Broker, Analysis of umbrella policy limitations

As this expert insight highlights, you cannot rely on an umbrella policy to cover this gap. Proactive management through your lease is the only reliable defense against the risks introduced by a tenant’s business.

The type of business your tenant runs directly correlates to the risk level and the potential impact on your landlord policy. Clear prohibitions in your lease agreement are your primary defense.

| Tenant Business Type | Risk Level | Policy Impact | Required Action |

|---|---|---|---|

| Remote computer work | Low | Generally acceptable | Document in lease |

| Home daycare | High | Can void landlord policy | Prohibit in lease or require separate coverage |

| Auto repair shop | Very High | Personal insurance doesn’t cover commercial activity | Strictly prohibit with lease enforcement |

| Online retail (inventory storage) | Medium | May trigger exclusions | Require tenant’s business insurance proof |

Key Takeaways

- Insurance classification of a structure is based on technical definitions like the “continuous heated envelope,” not just physical connection.

- Any business or rental use of a detached structure requires specialized coverage (endorsements or separate policies) to avoid voiding your standard homeowner’s insurance.

- High-value and custom structures must be insured for their full appraised “Replacement Cost Value” via a scheduled rider to overcome inadequate default coverage limits.

How to Build a Tailored Insurance Portfolio for an Eccentric Lifestyle?

For a property owner with a complex portfolio—a main house, a rental ADU, a home office, and perhaps other unique structures—a single insurance policy is an illusion. The only path to comprehensive protection is to abandon the idea of a one-size-fits-all solution and instead focus on building a layered, tailored insurance portfolio. This involves strategically combining different policies and endorsements, each designed to cover a specific risk, ensuring there are no gaps between them.

Thinking like an underwriter, you must deconstruct your property into its component parts and their distinct functional identities. Each element requires its own analysis and corresponding coverage layer. For example, a property with a main dwelling, a long-term rental ADU, and a professional music studio would require, at a minimum: a base HO-3 policy for the home, a separate DP-3 landlord policy for the ADU, and a commercial endorsement or policy for the studio’s business liability and equipment. Topping this off with a high-limit umbrella policy is crucial, but only if all underlying policies are correctly in place.

Example: Complex Property Insurance Portfolio

Consider a property with a main house ($500K), an Airstream trailer used as an Airbnb ($75K), and a detached music studio ($100K). A robust portfolio would require multiple layers: 1) A standard HO-3 policy for the main dwelling. 2) A separate commercial or specialized ADU insurance policy for the Airstream, as it’s a non-traditional structure used for short-term rentals. 3) A commercial endorsement or policy for the music studio to cover professional use and equipment. 4) A high-limit ($2M+) umbrella policy to provide excess liability coverage over all underlying policies. This layered approach is the only way to ensure every asset and activity is properly insured.

Navigating this complexity is not a DIY task. The most critical step is to engage an experienced independent insurance broker. Unlike a captive agent who only sells one company’s products, an independent agent can access a wide range of carriers to find the best policies for your non-standard risks. They act as your portfolio designer, conducting a gap analysis and layering coverage to create a seamless shield of protection. They will verify that each policy works in concert with the others, ensuring that a claim in one area doesn’t create an unexpected exclusion in another.

To begin this process, seek out a qualified independent broker with proven expertise in high-value residential and non-standard properties. This is the single most important action you can take to protect your unique and valuable assets.