Standard insurance policies are designed with intentional gaps that leave your most unique and valuable assets—from home businesses to prized collections—dangerously under-protected.

- A simple rider is often a cosmetic fix, not a structural solution for significant liability or value.

- Modern risks like cyber extortion and specialized equipment failure fall completely outside the scope of traditional homeowners coverage.

Recommendation: Shift from thinking about “add-ons” to strategically building a bespoke portfolio of targeted supplemental policies that address each specific risk individually.

As a hobbyist or collector, you understand value beyond a price tag. Whether it’s the curated precision of a stamp collection, the complex history of a firearm, or the nuanced potential of a wine cellar, these are more than assets; they are extensions of your passion. The common assumption is that a standard homeowners policy, perhaps with a small rider, is sufficient to protect them. This is a critical and costly misunderstanding. Standard policies are built for a standardized world, and they contain carefully constructed exclusions and sub-limits—what we in the industry call structural gaps—that your unique lifestyle inevitably falls into.

Most advice stops at “get a rider,” a solution that often proves woefully inadequate when a real-world scenario unfolds. The truth is, a rider is a patch on a fundamentally different type of risk. It rarely provides the robust liability protection, market-value replacement, or specialized coverage needed for non-standard assets or activities. The key isn’t to simply add more to a flawed foundation; it’s to build a separate, reinforcing structure. This is where the strategic use of supplemental policies comes into play.

This guide moves beyond the simplistic advice. We will explore how to construct a true coverage fortress by layering specific, targeted supplemental policies. We won’t just list what’s not covered; we will analyze why and provide the strategic framework for building a bespoke insurance portfolio that genuinely protects the eccentricities and passions that define your lifestyle. From your home-based business to the integrity of your wine collection, you will learn to identify the gaps and fill them with the right, powerful instruments.

To navigate this complex landscape, this article breaks down the most common and often overlooked coverage gaps. Each section will dissect a specific risk, explain why your standard policy fails, and reveal the correct supplemental strategy to ensure you are fully protected.

Summary: A Strategic Guide to Filling Insurance Coverage Voids

- Why Your Home Business Needs a Supplemental Policy Instead of a Rider?

- How to Protect Your Family from Cyber Extortion with Supplemental Coverage?

- Water or Sewer Line: Which Underground Risk Requires Supplemental Insurance?

- The Warranty Mistake That Leaves Appliance Breakdowns Uncovered

- When to Buy Supplemental Insurance for a Wedding at Home?

- How to Cover a Home Office in a Shed Without Voiding Your Policy?

- Temperature Change or Breakage: Which Risk Threatens Your Wine Collection More?

- How to Build a Tailored Insurance Portfolio for an Eccentric Lifestyle?

Why Your Home Business Needs a Supplemental Policy Instead of a Rider?

Many entrepreneurs and hobbyists-turned-professionals believe a simple rider on their homeowners policy is sufficient to cover their home-based business. This is a foundational error in risk management. A business rider is a minor endorsement, designed for minimal business activity with very low risk. It typically offers a token amount of coverage for business property—often capped at $2,500 to $10,000—and provides virtually no liability protection. If a client slips and falls in your home office, or if a product you sell causes harm, a rider will not protect your personal assets from a lawsuit.

The correct instrument for a serious home business is a Business Owner’s Policy (BOP). This is not a rider; it is a standalone, supplemental policy that bundles commercial property and general liability insurance. While a rider costs less, its limitations are severe. In contrast, a BOP provides genuine liability protection, often up to $1 million or more, and covers business interruption, loss of income, and can be scaled to add professional liability (errors and omissions) or data breach coverage as your business grows. The cost difference reflects this vast gap in protection; a business rider costs less than $100/year while BOPs average $600-$1,200 annually, but the value of the BOP is exponentially greater.

The following table clearly illustrates the structural differences and why a BOP is the only prudent choice for a business that has customers, inventory, or any meaningful revenue.

| Coverage Aspect | Business Rider | Business Owner’s Policy (BOP) |

|---|---|---|

| Average Annual Cost | Under $100 | $600-$1,200 |

| Liability Protection | Limited ($2,500-$10,000) | Up to $1,000,000+ |

| Scalability | Fixed limits | Can add employees, inventory, vehicles |

| Professional Liability | Not covered | Can be added |

| Business Interruption | Not covered | Included |

| Data Breach Coverage | Not covered | Can be added |

How to Protect Your Family from Cyber Extortion with Supplemental Coverage?

In our increasingly connected world, the threat of cyber extortion, or ransomware, is no longer confined to large corporations. Families, especially those with smart homes, multiple devices, and home-based businesses, are becoming prime targets. A standard homeowners policy offers zero protection against this modern threat. It was not designed to cover digital assets, data restoration, or ransom payments. If a hacker locks your family photos, financial records, or smart home devices and demands payment, you are entirely on your own.

To address this specific risk silo, you need a dedicated personal cyber insurance policy. This supplemental coverage is tailored to the realities of digital threats. It goes far beyond simply paying a ransom. Comprehensive policies cover the costs of professional negotiation with hackers, data recovery and system restoration by IT experts, public relations services to manage reputational damage, and even counseling for the emotional distress caused by the event. According to a cyber insurance market analysis, personal cyber insurance costs $25-$100/month, with average ransom demands reaching $2,000—a small price for peace of mind against a potentially devastating financial and emotional event.

The scale of this threat is demonstrated in the commercial world. A recent analysis showed that healthcare organizations, which hold highly sensitive personal data, faced extortion demands as high as $4 million in 2025. While your personal risk may not reach this level, it highlights the sophistication and high stakes involved in cyber extortion, making proactive protection through a supplemental policy a non-negotiable part of a modern insurance portfolio.

Water or Sewer Line: Which Underground Risk Requires Supplemental Insurance?

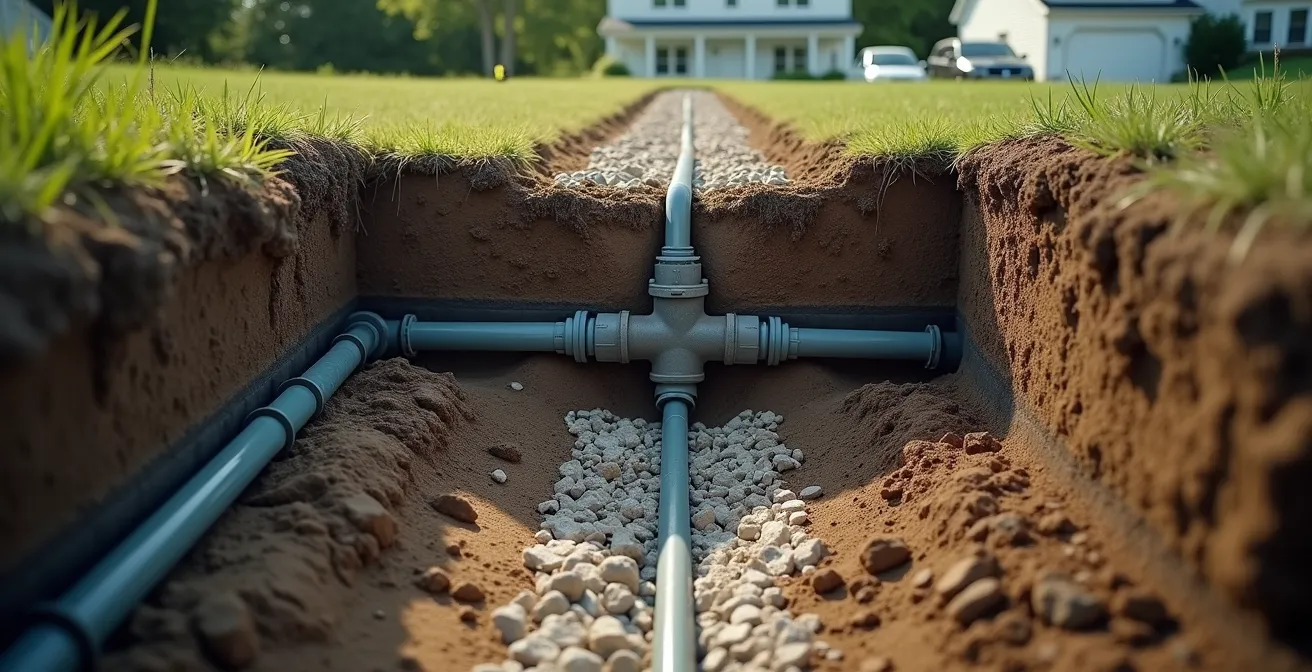

One of the most surprising and expensive gaps in a standard homeowners policy lies just a few feet underground. Your policy covers damage *inside* your home from a burst pipe, but it explicitly excludes the service lines—the water, sewer, and utility pipes running from the street to your house. If one of these lines collapses, leaks, or becomes blocked by tree roots, the repair costs, which can easily run into the tens of thousands of dollars, are entirely your responsibility.

This is because your responsibility begins at the property line, not at your foundation. The city or utility company is only responsible for the main lines under the street. The entire length of pipe on your property is yours to maintain and repair. A supplemental service line coverage endorsement is designed to fill this massive structural gap. For a small annual premium, it covers not only the cost of repairing or replacing the pipe but also the often-exorbitant associated expenses: excavation of your yard, driveway, or patio; street-cutting permits; and the complete restoration of your landscaping to its original condition.

As the illustration demonstrates, the “ownership zone” for these critical lines falls squarely on the homeowner. Factors like the age of your home, the material of the pipes (older homes may have clay or Orangeburg pipes prone to collapse), and the presence of mature trees significantly increase your risk. Both water and sewer lines present a substantial threat, and a single, affordable supplemental policy typically covers all underground service lines connected to your home, making it an essential component of a robust insurance portfolio.

The Warranty Mistake That Leaves Appliance Breakdowns Uncovered

Homeowners often fall into a dangerous complacency trap, assuming a combination of their homeowners policy and manufacturer warranties provides a complete safety net for their appliances and home systems. This is a significant mistake. A homeowners policy only covers appliance damage from specific “named perils” like fire or a lightning strike; it never covers mechanical breakdown or failure from normal wear and tear. A manufacturer’s warranty, on the other hand, is limited in time and scope, and often contains numerous exclusions.

This leaves a massive gap. What happens when your high-end HVAC system suffers an electrical failure just after the warranty expires? Or when your refrigerator’s compressor gives out due to a mechanical fault? The repair or replacement cost is entirely on you. The solution is a multi-layered approach. The primary tool is an Equipment Breakdown Coverage endorsement. This supplemental coverage is specifically designed to cover the mechanical, electrical, or pressure system failures that standard policies exclude. It’s the bridge between your homeowners policy and a warranty.

However, even that isn’t always enough. A home warranty can cover breakdowns from normal wear and tear, which equipment breakdown coverage might not. By combining these different instruments, you build a true safety net. For the collector with a climate-controlled wine cellar or a specialized workshop, protecting the systems that protect the assets is paramount.

Action Plan: Building a Complete Home Systems Safety Net

- Maintain your homeowners policy for coverage against perils like fire or lightning.

- Add an Equipment Breakdown endorsement for mechanical/electrical failures not caused by wear.

- Consider a home warranty to address normal wear and tear issues on major appliances.

- Build an emergency fund to cover any remaining coverage gaps and warranty deductibles.

- Document all appliances with purchase dates and warranty terms for quick reference during a claim.

When to Buy Supplemental Insurance for a Wedding at Home?

Hosting a wedding at home can be a beautiful and personal experience, but it also transforms your property into a commercial event venue for a day, creating liability risks your standard homeowners policy is not equipped to handle. Your policy’s liability limits are designed for everyday occurrences, not for an event with dozens or hundreds of guests, outside vendors, and potential alcohol service. If a guest is injured, or if a hired caterer causes property damage, you could be held personally liable for costs that far exceed your policy’s limits.

The solution is a supplemental special event insurance policy. This should be purchased the moment you begin signing contracts with vendors. This policy is a short-term instrument that provides two critical layers of protection. First, it offers high-limit liability coverage (typically $1 million to $2 million) for property damage and bodily injury that might occur during the event. Second, it can include cancellation coverage, which reimburses you for lost deposits and non-refundable expenses if you have to cancel or postpone the wedding due to unforeseen circumstances like extreme weather, a key vendor going out of business, or a sudden illness.

With insurance markets tightening, as evidenced by U.S. commercial property/casualty insurance rates rising 3.8% in 2024, insurers are increasingly strict about non-standard risks on personal policies. Attempting to rely on your homeowners policy for an event of this scale is not only inadequate but could also put your primary policy at risk of non-renewal. A standalone event policy is the only professional way to manage the risk.

How to Cover a Home Office in a Shed Without Voiding Your Policy?

The rise of remote work has led many to convert sheds and outbuildings into sophisticated home offices. However, this common-sense solution creates a complex insurance problem. A standard homeowners policy includes limited coverage for “other structures” on your property, but this coverage is typically capped at 10% of your home’s total dwelling coverage. A simple garden shed falls within this limit, but a high-end, fully finished office shed with expensive equipment, custom cabinetry, and dedicated electrical systems can easily exceed it.

Furthermore, if you are conducting business—especially meeting clients—in that shed, your homeowners policy will likely deny any liability claim related to that activity. This is a commercial risk, not a personal one. The solution requires a two-pronged approach. First, if the value of the shed and its contents exceeds the 10% limit, you must increase your “other structures” coverage. But more importantly, you need a supplemental Business Owner’s Policy (BOP). As we’ve discussed, a BOP provides the necessary general liability for business activities and commercial property coverage for your business equipment.

Relying on your homeowners policy is a gamble that could leave you with a voided policy and uncovered losses. According to Progressive Commercial data, the national median monthly cost of a BOP policy was $67 in 2024, a small investment to properly protect a significant asset and business operation. Without this supplemental coverage, your backyard office represents a major, uninsured liability.

Temperature Change or Breakage: Which Risk Threatens Your Wine Collection More?

For a wine collector, the collection’s value is contingent on its pristine condition. The two greatest physical threats are breakage and spoilage. A standard homeowners policy might offer some limited coverage for breakage if it’s caused by a covered peril like a fire, but it offers absolutely no protection against the more insidious and far more likely threat: spoilage due to temperature or humidity change. If your climate control system fails or a power outage occurs, and your collection is ruined, the financial loss is entirely yours.

This is where a specialized, supplemental collectibles insurance policy, often called a “personal articles floater,” is indispensable. Unlike a standard policy, it is designed to cover the unique risks associated with collections. When evaluating a policy for your wine, the primary concern must be spoilage coverage. This specifically covers losses resulting from the failure of climate control equipment or power outages. While breakage is a risk, it is often less frequent and can be mitigated with proper racking. Spoilage, however, can wipe out an entire collection silently.

A high-quality collectibles policy should be evaluated on several key points beyond simple spoilage. It’s not just about one risk, but a portfolio of them:

- Market Value Coverage: The policy must cover the current market value of your wine, not just what you paid for it.

- Transit & Off-Site Storage: Ensure coverage extends to wine being shipped or stored in a professional facility.

- Label Damage: For highly collectible bottles, damage to the label can significantly reduce value. The policy should cover this.

- Mysterious Disappearance: This covers a bottle that goes missing without evidence of theft.

- Ullage: Protection for loss due to natural evaporation over time, a key factor for long-term investors.

Key Takeaways

- Standard insurance policies contain deliberate “structural gaps” that leave unique assets and lifestyles unprotected.

- A simple policy rider is almost always insufficient for covering significant business activities, liability risks, or high-value collections.

- Modern risks like cyber extortion and equipment breakdown require specific, targeted supplemental policies as they fall completely outside the scope of traditional coverage.

How to Build a Tailored Insurance Portfolio for an Eccentric Lifestyle?

The central theme of protecting a unique lifestyle is moving away from a single, monolithic policy and toward a bespoke portfolio of targeted insurance instruments. An “eccentric” lifestyle—one with high-value collections, home-based businesses, frequent special events, or unique properties—creates a mosaic of risks that no single insurer or policy can adequately cover. The strategy is to layer different policies, each designed for a specific purpose, to create a seamless fortress of coverage.

For complex needs that go beyond a simple BOP, a Commercial Package Policy (CPP) might be the more appropriate supplemental tool. As one Business Insurance Comparison Study from 2024 notes, “A CPP is typically more flexible and customizable than a BOP, with a greater menu of options to choose from, but it is also generally more expensive.” This flexibility is key for a collector who also runs a business and hosts events.

The final, and perhaps most crucial, layer in this portfolio is a high-limit umbrella policy. This policy sits on top of all your other liability policies (home, auto, BOP) and provides an additional layer of protection, typically from $1 million to $50 million or more. As a case study in high-net-worth protection, leading insurers like Chubb and Liberty Mutual often source specialty coverage from markets like Lloyd’s of London for truly unique risks, then unify the liability under a massive umbrella policy. This is the ultimate safety net, protecting your entire net worth from a catastrophic liability claim that exhausts your primary policies.

The next logical step is to have your current policies professionally audited to identify these structural gaps and begin the process of building a coverage portfolio that truly reflects the value and uniqueness of your life’s passions.

Frequently Asked Questions on Supplemental Insurance Policies

Where does city responsibility for service lines typically end?

City responsibility usually ends at the property line or meter, not at your home’s foundation. Everything from that point to your house is your financial responsibility.

What hidden costs does service line coverage address?

Beyond pipe repair, coverage includes excavation costs, landscaping restoration, driveway repairs, street-cutting permits, and full property restoration to its original condition.

How do I assess my risk for service line issues?

Consider your home’s age, known pipe materials in your area (like Orangeburg), the presence of mature trees near service lines, and local soil conditions that can affect pipe integrity over time.